13.5 Interest Rate and Reinvestment Rate Risks

An additional, clarifying word about interest rate and reinvestment rate risks is warranted at this time.

If in general, interest rates go up, market prices for existing, “older” bonds will go down – and vice versa. General interest rates and bond prices are inversely related. In an environment where market rates have gone up, bond investors holding “old” bonds will receive less interest income than if they had purchased “new” bonds that were issued more recently – at higher (coupon) rates. This will cause market values for existing bonds to go down; they are simply worth less competitively. Rising rates are “bad” news for (existing) bondholders in terms of interest rate risk.

However, bondholders will be able to reinvest their interest proceeds at higher rates than before if rates rise. Investors receive regular, periodic interest payments over the life of the bond, which upon receipt, is assumed to be reinvested into other alternatives that pay higher rates than before. Thus, rising rates are “good” news for bondholders – in terms of reinvestment risk.

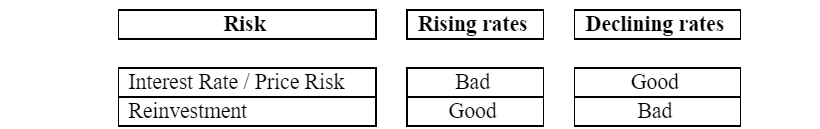

In short, interest rate and reinvestment risks are inversely related to one another. The table below summarizes the relationships vis á vis the bond investor.