2.9 The Balance Sheet, Net Income, and the Common Shareholder

Net income is an Income Statement number, which is also very relevant to the balance sheet.

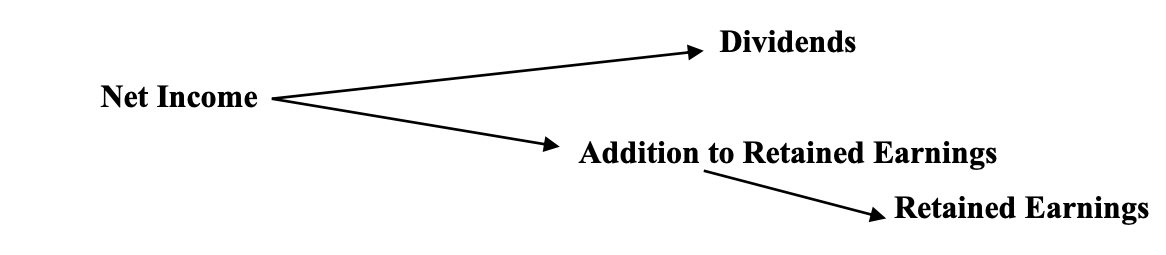

What happens to net income – or profits – after it is recorded? Let’s say the company records net income of $1 million for the year. If the company pays dividends to its shareholders of, say $100,000, those funds are now theirs and not the corporation’s. The shareholders are enriched to the extent of $100,000 (less taxes).

This leaves $900,000 in “addition to retained earnings,” which at the year’s end will be transferred by the accountant from the income statement to the retained earnings account in the equity section of the balance sheet. (This is done when the accountant “closes out the books” at year’s end, at which time the income statement reverts to zero.) Of course, as owners of the corporation, all retained earnings, in fact, belong to the common shareholders as well. Thus, from the point of view of the balance sheet, the common shareholders own both the “common stock” and the “retained earnings.” The preferred shareholders just own the preferred stock.