3.12 Accounting for Long-term Assets: Straight-Line Depreciation (For Reporting Purposes Only)

The following pages represent three depreciation-costing method alternatives for plant (i.e., buildings) or equipment, which are acceptable for reporting purposes (only). Remember that “property,” i.e., land, is not depreciated. There is an entirely different set of methods required for tax accounting, which we shall not cover herewith. The following methods are unacceptable for Tax accounting.

The first method we shall outline is called “straight line.” Under this method, we expense on the income statement the same amount of depreciation each year. If, for instance, the asset is estimated to have a five-year life, as in this example, we shall depreciate 1/5 or 20% of the asset yearly. This ratio will be applied against (i.e., multiplied by) the difference between the property’s historical cost and its estimated salvage value. (Note the key word: “estimated,” which is used here for the second time.) Herein we shall refer to this difference in the two numbers as the “depreciable amount,” a phrase, which we use here, but which you shall not find popularly used elsewhere.

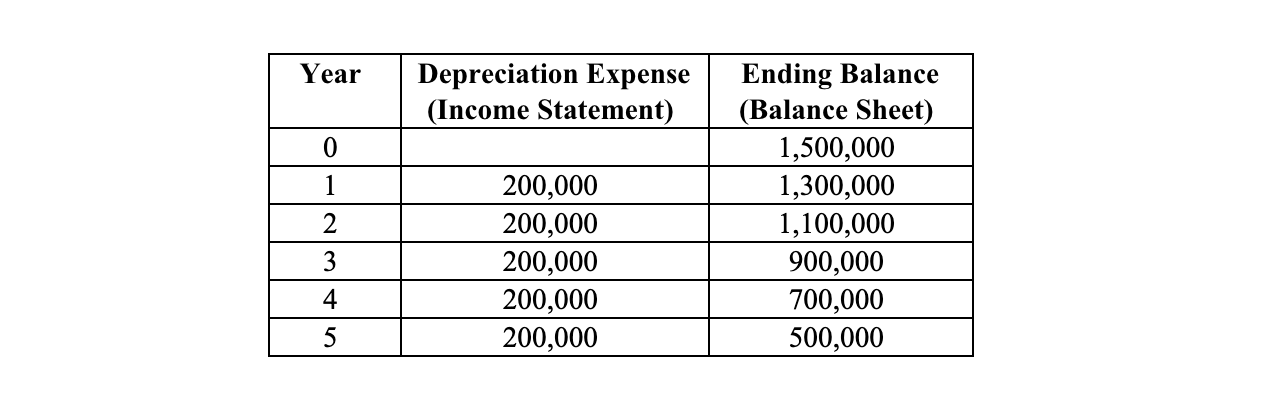

Let’s assume the following:

As you read this and the next two examples, remember that “Salvage Value” does not apply to buildings but only to equipment. Also remember that property, i.e., land, cannot be depreciated.

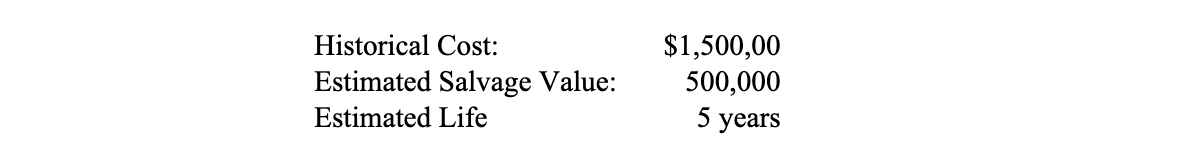

In “year zero,” which means “now” (see table below), the asset shall be carried on the balance sheet at its original, historical cost of $1,500,000. Each subsequent year, we shall depreciate 1/5, or 20% of the difference between the cost and the salvage value, this difference being: $1,500,000 – $500,000 = $1,000,000. Thus, the depreciation expense is: $1,000,000 ÷ 5 = $200,000 each year.