3.13 Accounting Entries for Depreciation

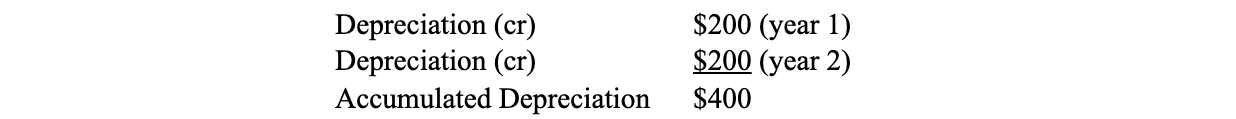

The following represents the accounting book entries for straight-line depreciation in the second year (from the prior page), by way of example.

(000)

Income Statement Book Entry

Depreciation Expense (dr) $200

Balance Sheet Book Entries (End of second Year)

Note above that the debits are indented to the left, and the credits are more to the right. That’s as it should be.

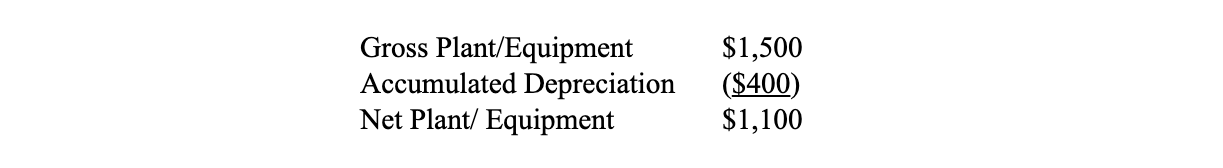

Balance Sheet Appearance

The balance sheet, at the end of the second year, will contain the following items:

You will recall that equities are credit balance accounts. As noted earlier, you should think of the income statement as part of the equity section of the balance sheet. This is not a stretch as retained earnings are derived from the income statement, i.e., when the “addition to retained earnings” are transferred to the balance sheet – at year’s end, at the time that the books are closed. Therefore, think of revenues as credits, and expenses as debits.

-Solomon ibn Gabirol