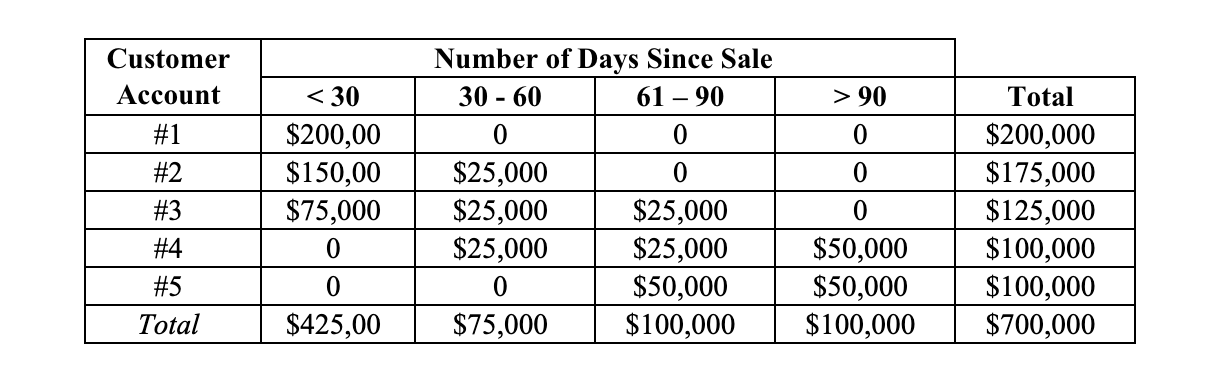

5.7 Accounts Receivable Aging Schedule

An aging schedule is an internal, managerial, and confidential document, which shows, account by account, how much money is due the seller from the time of sale, and whether a customer account is “current” or is “past due.” It is a necessary management tool.

The schedule would provide the external analyst with much more than s/he may otherwise know by alternatively calculating Days Sales Outstanding. It is much more detailed. Unfortunately, the schedule is an internal management document and unavailable to outsiders.

The customer accounts are listed row by row, either by name or some some other identifier. Since most credit sales require payment within 30 days, the first column shows how much money is due where the sale occurred less than 30 in the past. As you read to the right, you will see uncollected credit sales figures that are more than 30, 60, and 90 days old, and the respective amounts due. Thus, the schedule might look somewhat like the following. In examining the schedule, what might you tentatively conclude about each of the five listed accounts?

By examining this schedule, the analyst may uncover some interesting findings. For instance:

- ACP/DSO may be higher than the company’s sales terms due, possibly, to one very large account skewing the average. It may also be greater due to the company’s decision to enter a new geographical or product market, knowing in advance that such entry will slow down its collections, but expecting that the added profits will make the expansion worthwhile.

- The analyst may see how many accounts are current and how many should be written off – analytically – by the analyst. (Remember: this is not accounting, so a real “write-off” would be recorded by the accountant.)

- This schedule does not tell the reader anything about the profitability of the accounts (but neither does the ACP). It could very well be, for instance, that account #1, which apparently pays well, is also purchasing very low margin products. While not necessarily of great importance to the Accounts Receivable manager, the marketing manager may be very interested in profitability.

- Overall, it appears that the company has $425/$700, or 60.7% of its receivables that are “current,” i.e., not past due – assuming 30-days collection terms.

- The Aging Schedule implies a certain ACP. In order to calculate the ACP, it is necessary to know the Credit Sales figure, which is publicly available from the company’s Income Statement.