6.3 The DuPont Model

The DuPont Model was developed by managers at the DuPont Chemical Corporation for purposes of internally pinpointing strengths and weaknesses within the company’s management hierarchy. Imagine you are at the top of the corporation, that you are the chairman of the board or CEO, and you answer to the company’s shareholders. Arguably, the one ratio you are most interested in would be the company’s return-on-equity ratio. Whether the ROE looks good or bad, you would wish to look further into the performance of the company, make improvements, increase efficiency, and buttress strong areas.

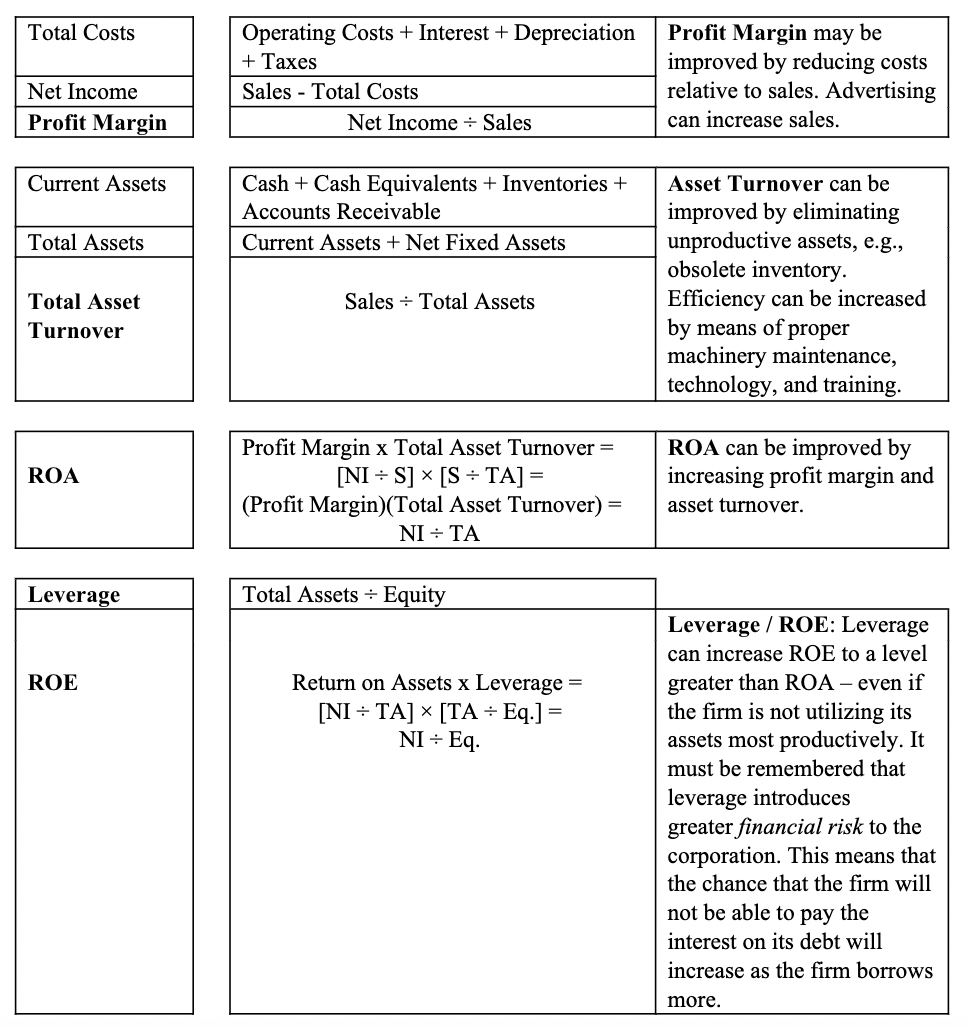

The DuPont formula provides upper management with a top-down look into the company’s performance culminating with ROE, which, again, is of the most interest to company shareholders. The CEO looks into three critical areas: 1. Profitability (“Profit Margin” – see below), 2. Operating (“Total Asset Turnover”), and 3. Financial perspectives (“Leverage”).

Some Key Points:

- Good business management produces a favorable ROA.

- Proper leverage may enhance the investor’s return – ROE. Without Leverage, ROA = ROE.

- You will notice that the ROA and Leverage ratios do not match up with our earlier definitions.