9.10 Chapters Eight & Nine: Review Questions

Chapters 8 – 9: Review Questions

- Define each of the following terms: Incrementalism, Sunk Costs, and Cannibalization.

- In words, explain what is meant by Free Cash Flow.

- Why is FCF important? Give two reasons.

-

- How do we use this model – for individual projects, for the entire corporation, or both? Explain.

-

- What options does the company have regarding how it may choose to utilize its Free Cash Flow?

-

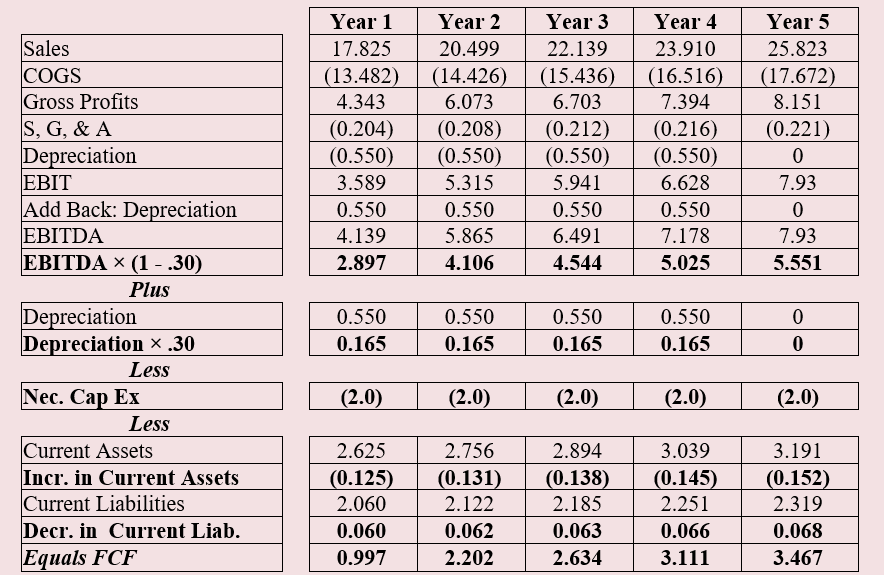

- Create a Free Cash Flow template and spread the forecasted numbers based on the following assumptions:

- Last year’s sales were $15.5 million and are expected to grow for the next two years at 15% per year, followed by three years of 8% growth.

- Cost of Goods Sold last year were $12.6 million and are expected to grow at a 7% rate per year indefinitely.

- Depreciation is $550,000 per year at a straight-line rate; in the fifth year, the building will have been fully depreciated. This company has no depreciable equipment.

- There is no amortization.

- Selling and General Administrative expenses last year were $200,000 and will grow modestly at an annual 2% rate.

- This company is in the 30% tax bracket, including Federal and State. There are no local taxes.

- The company expects to spend $2 million each year on “CapEx,” all of which will be necessary.

- Last year’s Current Assets, excluding Cash, were $2.5 million, and is expected to grow at a 5% rate per year indefinitely.

- Last year’s Current Liabilities were $2 million and are expected to grow at a 3% rate for at least five years.

- How does the analyst handle depreciation in the FCF Model? Why does s/he handle it that way? Note that depreciation occurs twice in the formula.

- Can you list all four capital items, which are included in the Balance Sheet?

- Why don’t we include capital costs in the FCF Model?

- An increase in Current Assets provides for/uses funds. Which is it? Why?

- On what basis do we distinguish between “internal” and “external” funds?

- List some internal and external funds.

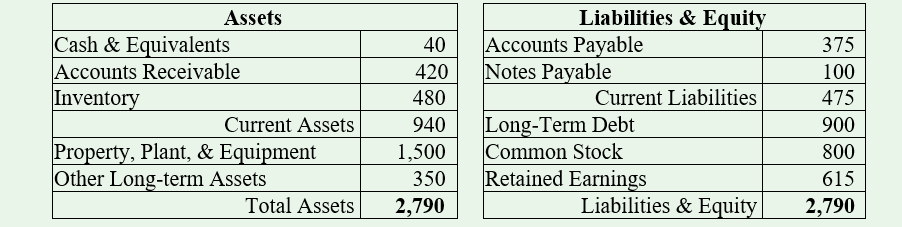

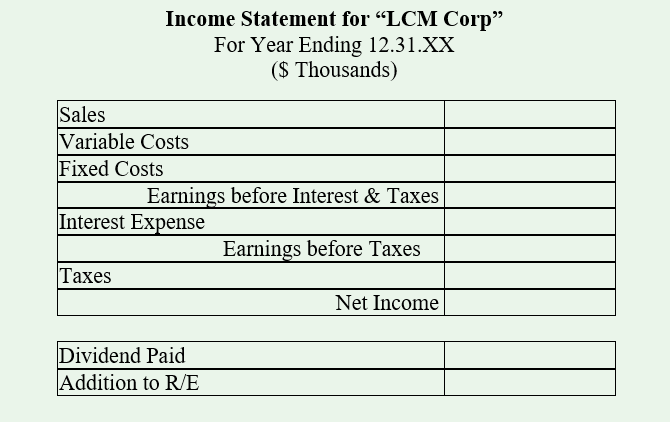

- Calculate the External Funds Needed formula for the LCM Company (below), based on the following assumptions.

- Last year’s sales were $5,000 million.

- Next year’s objective is to increase sales by 30%.

- Variable costs will be 70% of sales. (Variable costs change with sales volume.)

- Fixed Costs are expected to run 30% of P, P, & E (Fixed costs do not change and are unrelated to sales volume.)

- Interest Expense is 5% of Notes Payable and 7% of Long-term debt.

- Taxes are 40%.

- The company expects to maintain its Payout Ratio at 20% of income.

What is the company’s EFN if it is to meet its growth objective?

- What do this year’s three Solvency ratios look like?

- Why will the company’s financial ratios change next year?

Selected Answers To Chapters 8 and 9

FCF Table

- You are ill-advised to do this by XL. Do it by hand. Place it in a Word table.

- One needs to figure EBIT by adding in the Income Statement data to the template in the chapter.

- “Last Year’s” numbers are not illustrated in this Spread Sheet.

- “Year 1’s” numbers follow “Last Year’s.” For example, Last Year’s Sales were $15.5 Million. “This Year’s” sales increased by 15%. Therefore: (15.5) (1.15) = $17.825.

- Be careful about the Current Assets and Current Liabilities numbers. We first calculate increases or decreases, not the gross numbers. Which data add to FCF?

($ Millions)

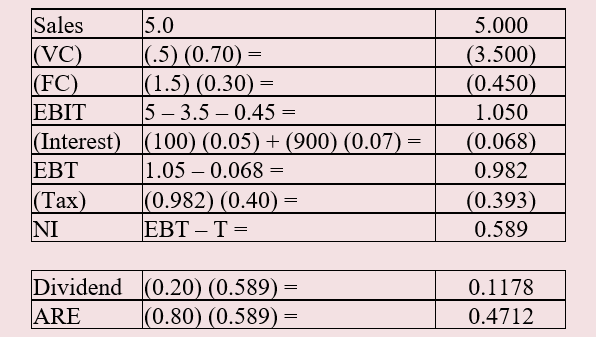

EFN Formula

($ Millions)

I have assumed, in the question itself, that the B/S and I/S data are stated in Thousands, rather than Millions. This is more palpable. Note that here, the numbers are simplified to Millions; it’s shorter. Assume that PR = 20%. Beware the differences!

-

- D/E = (900 + 475) / 1,415 = 0.97

- D / TA = (900 + 475) / (900 + 475 + 1,415) = 0.4828

- TIE = EBIT / I = 1.050 / 0.068 = 15.44x

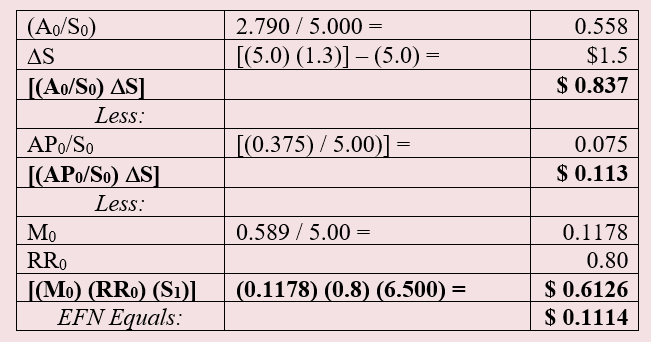

- EFN = [(A0/S0) ΔS] – [(AP0/S0) ΔS] – [(M0) (S1) (RR0)]

- We will assume “Static Analysis.”

($ Millions)

- Sales and VC will change next year, but FC will remain the same. Therefore, we should see a change in the net profit margin, and changes in the dividend paid and retention rates – assuming no change in payout (percent of earnings) policy.